Disclaimer: The information contained in or provided from or through this article and this entire website is not intended to be and does not constitute financial advice. You understand that you are using all information available on or through this website at your own risk.

mental sanity NEEDS A RELIABLE STORE OF VALUE

In 1519, Hernán Cortés and his 600-man strong Spanish troops invaded Mexico, back then an isolated part of the world. The Aztecs, who lived in Mexico at the time, noticed how the aliens showed an extraordinary interest in a particular yellow metal. It seemed like they never could stop talking about it. The Aztecs were not unfamiliar with gold. They used gold to make jewelry and statues, and occasionally used gold dust as a medium of exchange. But when Aztecs wanted to buy something, they generally paid in cocoa beans or bolts of cloth. The Spanish obsession with gold seemed inexplicable. What was so important about a metal that could not be eaten or drunk, and was too soft to use for tools or weapons? When the local people questioned Hernán Cortés, he answered:

“Because I and my companions suffer from a disease of the heart which can be cured only with gold”

Hernán Cortés having a chat with Aztec.

This story, above all, tells about the psychological need for safety and reliability.

Whatever small or large wealth you have accumulated with hard work, you need to have a way to store it reliably. The value of your wealth needs to be retained until the following year, after the next 10 years, and all the way to your offspring.

The gold has served this need for thousands of years, and for good reasons.

However, this is about to change the first time in human history.

Physical gold is gradually being replaced by digital gold. That is, Bitcoin.

In the quest of the hardest Store of Value

I’m writing this article in May 2021. We’re about halfway through the largest crypto bull market in history.

You can hear investment tips from taxi drivers. Many of us have witnessed our friends going nuts over cryptos. The bull cycle has happened every four years, mimicking Bitcoin’s mining reward ‘halvening’. Perhaps you remember the end of 2017 and 2013. It was similar crazy times back then.

With this blog post, I want to cut through all the buzz and noise in the markets and get back to fundamentals: What are the traits of the hardest Store of Value?

In the first part of this blog post, I explore the fundamentals of money and the Store of Value. I summarize the history from gold coins in the Roman empire, the creation of fiat paper money, how fiat money was debased from physical gold in 1971, and how blockchain emerged as a superior technology to create global consensus and Store of Value. Bitcoin is universally regarded as ‘digital gold’, and I explain the fundamentals behind this.

In the second part of this blog post, I compare Bitcoin and Ethereum from the Store of Value perspective. While Bitcoin is considered ‘Digital gold’, Ethereum has been traditionally categorized as ‘Digital oil’. As we are approaching Ethereum 2.0 upgrade, with its new deflationary economics, some people have started to call Ethereum ‘ultrasound money’, or “Digital bond”. I will debunk the reality behind this meme.

This blog post is written so that even a beginner could follow it. It will get quite technical, though, so bear with me.

If you are already feet deep in the crypto metaverse, and you already understand the ‘digital gold’ narrative, just skip directly to the second part of the blog post.

My crypto background

I encountered Bitcoin first in 2013 when I was studying Computer Science. I studied Bitcoin white paper and blockchain technology with great fascination. I understood part of its potential. I bought my first Bitcoin the same year with 36.38 EUR, just to find out a few weeks later it was hacked from the preliminary web wallet. However, it was years later when I studied the history of money, and when my mind was truly blown.

Over the years, I’ve been studying blockchain and cryptos for thousands of hours in the form of several books, white papers, podcasts, top thinkers, VCs, and scientists in the field. I have met hundreds of people in different crypto conferences in Europe and Asia.

Article part 1/2

From Gold to Bitcoin and Beyond

Crypto markets today in May 2021

Let’s have a look at the crypto market capitalization as of today in May 14th, 2021:

Block size visualizes the relative market cap - Bitcoin is the largest, Ethereum is the 2nd largest. Pic from Coin360

The total market cap of all cryptos combined is USD 2.25 trillion:

Out of that, the Bitcoin market cap is $0.922 trillion.

Ethereum (ETH) market cap is $0.441 trillion.

All other cryptos combined: is $0.887 trillion.

So, you might ask, from a macro perspective, are these numbers significant or not? Let’s do some comparisons.

We can compare crypto market cap to nation-state GDPs. Bitcoin market cap is larger than the GDP of 90% of 187 nation-states, according to World Bank. If Bitcoin were a nation-state, it would be the 15th largest nation-state, larger than Saudi Arabia or Switzerland.

If the market cap of all cryptos combined were one company, it would be the largest company in the world. Larger than Apple, which is the largest company with over 2 trillion USD of market capitalization.

As the last data point, the combined market capitalization of cryptos surpassed the value of all US dollars in circulation this year.

The market cap of physical gold is around 11 trillion. Bitcoin needs to only 11x to reach that. Since its inception, Bitcoin has grown on average over 200% annually for 11 years. Extra 11x won’t be a stretch. The influx of institutional money has merely started, with Tesla, Square, MicroStrategy and over 20 public companies holding Bitcoins in their balance sheet. Bitcoin ‘flippening’ physical gold market cap is just a matter of few years.

Finally, it’s good to understand that crypto markets are highly cyclical yet in a surprisingly predictable manner. Historically, there has been a bull market every four years with prices soaring sky-high, followed by a massive crash. This cycle correlates with the Bitcoin mining reward, which has been programmed to slice in half every four years (‘halvening’). At the time of writing this blog post, in May 2021, we are in the middle of the bull market. Previous bull cycles happened in 2017 and 2013.

History of money — from gold coins to paper money

Traditionally, the hardest currency of the planet has been physical gold. It has been the best store of value for thousands of years. And not only a store of value, but gold was simultaneously used as the local day-to-day money and money for international trade.

In history, national currencies didn’t play that much role as they do today. Yes, old empires had their own gold and silver coins, but they were practically interchangeable with any other gold and silver coins based on their weight in grams.

Silver drachma of Marcus Aurelius, the legendary Roman Emperor whose wisdom has become trendy lately

Why has GOLD remained the hardest Store of Value throughout thousands of years?

Gold has remained as a Store of Value mostly because its Stock-to-Flow ratio is high. There is a major difference between annual production and the total available supply of physical gold.

In numbers, this means that, e.g. in 2017, the total amount of physical gold was approximately 190,000 tons (this is the ‘stock’). Annual mine production was around 3,100 tons the same year (this is the ‘flow’). If you do the simple math, it would take 64 years to double the total stock of gold at the current production rate. In other words, the inflation rate of gold is around 1.64%, which is the inverse of 64. If someone stores their wealth in gold, it is difficult for someone to dilute its value by more than 1.6%.

Gold is valuable because its annual production relative to the existing stock is so small. If you examine the historical production rate of gold, it has remained on average at 2-3% of the gold stock per year over many decades.

The asset which has the highest Stock-to-Flow ratio is high contender to win the store of value game. It’s not the only required feature, for example durability and divisibility are important too. People will naturally tend towards the best store of value, just like we witnessed with the Spanish invader and his troops in Aztec. It is not convenient to have multiple forms of Store of Value.

Gold is ‘hard money’ because of the laws of nature, not because of policies or laws set by people. As we will learn later in this blog post, currency system whose supply can be tampered by humans has consistently failed.

In our fiat economy, failure happens because inflating (printing) new money is the easiest way for governments to solve problems. That is because austerity (raising taxes) causes more pain than benefit, big (debt) restructurings wipe out too much wealth too fast, and transfers of wealth from haves to have nots don’t happen in sufficient size without revolution.

Stock-to-flow ratio of Bitcoin compared to physical gold. Bitcoin will surpass gold in just a few years.

Banks and paper money was invented because gold was heavy to carry and risky to store

Gold was a great Store of Value, but it wasn’t convenient in day-to-day transactions. It was heavy to carry around and also not very divisible. Also, it was unsafe to keep all of your life savings in your home if someone would break in.

The banking system solved both of these problems. You could bring your gold to the local bank, store them safely, and then get paper currency in exchange. You could trust this arrangement because you knew that the paper currency is backed by gold, and at any given time, you could walk into your bank and ask them to change the paper currency back to gold.

This system worked somewhat well until the paper money wasn’t backed by gold anymore.

In the 1960s, the US federal spending skyrocketed due to an expansion of entitlement programs. At the same time the US was boosting its defense spending because of rising costs of Vietnam war and Cold War with Soviets. The increased debt eventually caused a depletion of America’s gold reserves from over 20 metric tons in the late 1950s to under 10 metric tons by 1970.

Sensing the situation was no longer tenable, in August 1971, the US President Richard Nixon announced the ‘temporary’ suspension of the dollar's convertibility into gold. The so-called Bretton-Woods system collapsed over the following two years, and the dollar has been a “fiat” currency ever since.

Suddenly, dollars were just collective hypnosis. No law of nature controlled their scarcity anymore. This set out a massive increase in fractional reserve banking. In layman’s terms: money printing. Fiat money has lost a tremendous amount of value against gold due to the extensive money printing, especially after 1971.

History is full OF currencies that have been debased

Debasing money is by no means a recent invention. Whether it’s the debasement of currency in the Roman empire (in 200-300 AC), glass beads in West Africa (late 18th century), or RAI stones in Yap Island (in the 19th century), the history is full of similar stories. Currency is debased, it gives a temporary fix, but soon creates a monetary monster that cannot be solved. Most of the time, the empire collapses.

The debasement of currency in the Roman empire — The rapid decline in silver purity of the Antoninianus coin

In the 20th century, we can find similar examples of hyperinflation in countries such as Austria, Germany, Hungary, Zimbabwe, China, Yugoslavia, Greece, Armenia, to mention just a few. Do you think something similar wouldn’t happen in the US and Europe in the near future? Well, we’re on a highway full speed to this destination. Tighten your seatbelt. Politicians and central bankers of today are repeating history as we speak.

WTF happened in 1971

Now, it’s an excellent time to take a break, and browse this site for 2 minutes: https://wtfhappenedin1971.com/ — It gives you great laughs and makes you terrified at the same time.

“No way… US dollar of today is the reserve currency of the world! It cannot be debased!”

Oh, really?

In the entire history of the United States, it is estimated that over 20% of the circulating US dollar was printed in 2020 — from 1776 to 2020, over 20% of the money was printed in a single year. Let that sink in.

Yes, you might argue part of this printing was necessary to cover the expenses related to Covid, and you would be right. However, if printing is possible, it just always gets out of hand.

During the last few years, money printing has been inflating the prices of stocks, real estate, land, all the scarce assets like never seen before. These assets are largely owned by the middle class and especially wealthy people. Money printing is effectively universal basic income to people who own appreciable assets, and significant dilution for the younger generation who haven’t been able to accumulate much of these appreciable assets and savings yet.

Slowly and surely, inflation is also reaching commodities. Commodity prices of 2021 have increased compared to the previous year: Lumber 265%, gasoline 182%, soybeans 72%, and sugar 59% just to mention a few.

The main takeaway from the history of money is that humans have constantly screwed it up. Every. Single. Time. Debasing currency is easier than raising taxes. It was as true thousands of years ago as it is today. It always gets out of hands, in a way or another.

Jerome Powell, FED chair since 2018. With his lead, 20% of all US dollars were printed in 2020.

Let’s sum it all up — Why is the economy heated all the time?

The economy has been heated and on the brink of collapse since the financial crises in 2009. You can find many explanations for this, but ultimately, it comes to the fact that our current monetary system is not backed by the laws of nature or laws of physics.

Not too many decades ago, we had laws of nature (gold), creating the trustworthiness of paper money. Things were much more stable and predictable back then. Today, there are no laws of nature or laws of physics backing up the money we use.

Fiat currencies are backed by bunch of regulatory agencies, laws, and police. And ultimately army, especially in the case of the US. One can do a bit of research about countries that have tried to use other currencies than USD to trade oil. We’re constantly moving from a crisis to the next crisis, and the crisis expand to foreign political dimensions.

I want my money to be backed by the laws of physics again!

The big question is, would there be a way to introduce the laws of physics back to our monetary system? Would there be a way to return to sanity? Is there hope?

The good news is that we indeed do have hope. The hope is already available for anyone who cares to 1) study the history of money and 2) study how blockchain technology works, and 3) be invested in the blockchain space for the long term.

That’s great news for everyone, especially for the younger generation, who have been sidelined in the current economic structures.

So, how can we get the laws of physics back? What makes a good Store of Value?

We use money every day, and few of us genuinly understand the properties that make a solid Store of Value or good day-to-day money.

Let’s have a look at the chart below:

As we can see from the chart, unlike Fiat money, Bitcoin is scarce. There will be only 21 million Bitcoins ever. Unlike Fiat money, Bitcoin is also backed by laws of physics. When something is scarce and backed by laws of physics, it functions as a reliable store of value when there is increasing demand for the asset. Bitcoin indeed has that demand. If you compare Bitcoin to the Internet, we are living in the year 1997. Bitcoin has as many users as the Internet had in 1997. The growth rate is just much higher.

Bitcoin is not only a good Store of Value, it’s actually a convenient way to do large transactions. For example, let’s say you would need to transfer USD 10 million worth of value from Europe to the US.

If you start moving USD 10 million of physical gold, that is a costly operation. The logistics costs alone are incredibly high because gold is heavy. On top of that, you need special safety arrangements to protect the gold bars. This comes with a high cost as well. The transaction is extremely slow and will take weeks, including all the preparatory work. Finally, the customs house of the receiving country might delay the shipment even further and, at worst, tax or confiscate it.

Let’s examine a similar transaction using Bitcoin. The logistics cost is the transaction fee of the Bitcoin network. This is anything between 5 to 20 dollars depending on the current transaction volume of the Bitcoin network. The preparation time to do the transaction is few minutes, or if you are using extra secure multi-signature wallets, few hours at most. The transaction arrives in few minutes. The transaction is censorship-resistant, and nobody can prevent you from sending or receiving Bitcoins.

As you can see, Bitcoin is an excellent way of transacting when it comes to large enough transactions. Small transactions (Day-to-day money) and large transactions (Store of Value money) have different requirements, though. It doesn’t make much sense to buy a bag of groceries with Bitcoin if you need to pay 20 dollars in transactions fee. However, when you invest anything more than 1000 dollars in Bitcoin, that transaction fee doesn’t really matter. A transaction fee is a price that you pay for the security of the network.

If Bitcoin is the hardest Store of Value, how does the future look like for gold and governments?

Central banks have traditionally backed their paper money with the hardest Store of Value asset. That’s why all central banks have sizeable physical gold reserves. Governments need to continue storing the hardest Store of Value asset in their reserves now and in the future, to be credible to issue their own paper money that the general population will trust.

But hey, gold-peg was removed already in 1971, right? And we just proved that Bitcoin is already a better Store of Value than physical gold? What value does the gold have as a reserve asset in the future?

Well, that’s a great question. And I’m sure all central banks are pondering this exact question right now. First time in history central banks have a competitor: decentralized blockchain technology.

I believe the last few decades of detaching our monetary system from the nature of physics has been a temporary period. Humanity is demanding sanity, and thus, laws of physics.

We already have over 20 publicly listed companies holding Bitcoin in their balance sheets, such as Tesla, Square, and Microstrategy. Many other corporations will learn and follow them. After few years, Bitcoin will subsume and flip the physical gold market cap.

In the next bull cycle in 2025, I predict some smart governments will start buying Bitcoin in their central bank reserves. Singapore is an exception because they have been accumulating freshly mined Bitcoins already for some time — damn, how smart folks. If Bitcoin holds the fundamentals of the best Store of Value asset in the world, Bitcoin will gradually start subsuming negative-yielding sovereign debt market. Institutional investors (investment funds, pension funds, etc) begin to allocate their wealth to Bitcoin.

Governments running their own currency, need to back it up with the hardest Store of Value. I can see no way around it. Traditionally, it has been physical gold. In the future, besides physical gold, it might be inevitable for central banks to have Bitcoin (and a basket of the largest crypto assets) in their reserves. After all, these crypto assets will have a higher Stock-to-Flow ratio than physical gold, and supply cap that cannot be easily tampered.

I don’t believe government currencies would disappear anytime soon. After all, governments have the power of law in their territory, backed by the police, a bunch of regulators, and ultimately the army. They can enforce their own currency for day-to-day transactions. However, if the currency is not credible, people have the decentralized options available. When it comes to savings and investments, people can use whatever decentralized currency serves them best. Government can at most hinder this a bit, but they cannot stop it.

In the long-term, I see a future where it’s totally irrational for governments and traditional banks to prevent the change. If you can’t beat them, join them. I believe traditional banks and central banks (with their CBDC money) will join the unstoppable shift from old legacy finance technology to build on top of the blockchain technology. Smart contracts and algorithms will play much larger role than they do today.

Right now, Bitcoin is thermodynamically hardest Store of Value

Bitcoin is currently the hardest Store of Value on the planet. There are no signs that any other asset could beat the Store of Value fundamentals of Bitcoin in the next few years. The most secure, decentralized and time-tested consensus mechanism backs it. No one has been able to hack it during its 11 year of existence. Bitcoin’s supply is capped at 21 million, and it has the largest network effects (most users) compared to any other cryptocurrencies. Finally, it’s backed by laws of physics and thermodynamics, which we explore in the second part of the blog post.

This is the end of the first part of this blog post.

If this was too much for you to stomach, and you can’t quite wrap your head around everything, it’s normal. To understand the entire monetary transformation the world is currently going through, one needs to 1) study how blockchain technology works and 2) the history of money.

The best starting point is to read Bitcoin Standard by Saifedean Ammous. This book tells the history of money.

Article part 2/2

Will Ethereum take over the status of Bitcoin as a Store of Value?

In the second half of the blog post, we compare the Store of Value traits between Bitcoin and Ethereum.

First, I’d like to emphasize that in this article I’m specifically talking about Ethereum’s version 2.0. Ethereum 2.0 is not launched at the time of the writing of this blog post in May 2021. The estimated launch schedule for EIP-1559 tokenomics upgrade is scheduled for July 2021 and the Proof of Stake migration to early 2022.

Ethereum flippening?

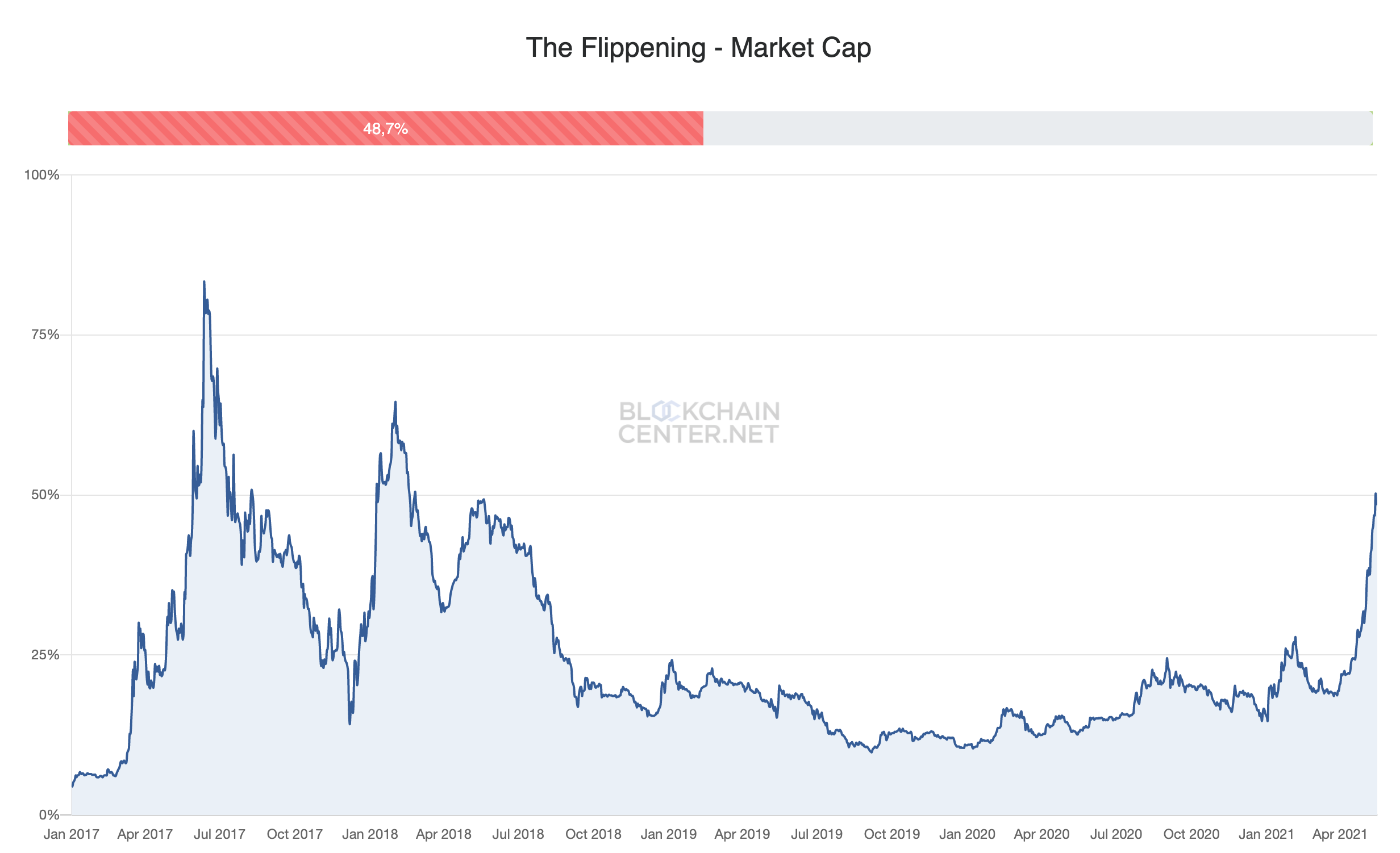

Ethereum flippening means that Ethereum’s market cap would surpass the market cap of Bitcoin. Every time we are in the bull cycle, this narrative comes up as Ethereum price (in BTC terms) has historically rallied a lot then. In the last bull cycle in 2017, Ethreum’s market cap was already over 83% of Bitcoin’s market cap at the highest peak — see the graph below.

You can compare the ‘flippening’ metrics between Bitcoin and Ethereum on the Blockchain center website.

I will argue that Bitcoin will remain the best Store of Value for the next few years. I believe Ethereum won’t permanently flip Bitcoin in this bull cycle for numerous reasons I will explain below. There is a chance that the Ethereum market cap temporarily exceeds that of Bitcoin, but I don’t believe it would be permanent.

Comparing Bitcoin’s and Ethereum’s Store of Value fundamentals:

I put together a summary of traits required from Store of Value crypto asset:

Let’s go through every trait one by one.

Scarcity

This is the easy part to understand.

If there are only 21 million Bitcoins, and no stakeholder can issue more of them, the asset is scarce. The more there is demand, the more the price goes up. Some more humorous folks than me call this NGU technology.

So far, Ethereum’s supply has been not capped. Ethereum was earlier regarded as ‘Digital oil’, and unlimited supply was considered to be okay by the Ethereum community. This sentiment has taken a 180 degrees U-turn, though. If bitcoin is considered to be ‘sound money’, the Ethereum community has recently voted that Ethereum needs to turn into ‘ultrasound money’. That is, Ethereum will turn into a scarce deflationary asset with the Ethereum 2.0 update.

Oh, pardon me. If you were left wondering, the “NGU technology” stands for Number Go Up technology.

Supply predictability

For supply predictability, we need to look at history and future plans.

Bitcoin’s is supply is as predictable as it can be. The supply cap was set to be 21 million in the genesis. As of today, around 19 million bitcoins have been mined. All stakeholders in the Bitcoin community have financial incentives to keep the supply cap as it is. Things are fairly simple.

Ethereum’s supply is a complicated story. Initially, Ethereum’s supply was not capped. The amount of issuance has changed over the years quite considerably, based on updates to the protocol. You can have a look at the graph below.

The most massive change is still ahead, though. This is EIP-1559. EIP stands for “Ethereum Improvement Proposal”. EIP-1559 upgrade, labeled “London hard fork”, is scheduled for July 2021. This will indeed turn Ethereum into a deflationary asset, meaning that its supply will decrease over time. This is quite a smart dynamic issuance/burning mechanism. In overly simplified terms, it means that if the number of transactions is high, part of the transaction fee will be burned, thus reducing the total supply. On the other hand, total supply will increase in case the number of transactions starts to drop.

Another massive change is Ethereum’s shift from Proof of Work to Proof of Stake consensus algorithm. This is schedule to happen after EIP-1559, in the end of 2021. This means that Ethereum miners (or in the future: validators) don’t need to sell most of their mined Ethers to fund electricity and equipment. This will decrease the sell-pressure of Ether.

You probably can guess what these two massive changes will do to the price of Ether the asset? Justin Drake from Ethereum Foundation presented interesting excel models on Bankless podcast how this would look like. Yup, if the upgrades go through successfully, the price of ether the asset will most likely go up quite a bit.

All this said, the upgrade to Ethereum 2.0 is highly complex, and it’s something never done before. The upgrade has been in the works for years and delayed several times. Although the Ethereum community seems to take all the necessary precautions and the time they need, such a massive upgrade has a safety risk, and that is not a good Store of Value trait.

So, how about the ‘ultrasound money” meme? Yes, the supply economics indeed look really bullish for Ethereum 2.0. However, ‘ultrasound money’ has many more properties besides issuance, such as safety and predictability. Safety of Proof of Work is still to be time tested. Ethereum development or supply issuance hasn’t been very predictable, either. Thus, in my books, this meme is a bit misleading and can be considered as clever marketing for new retail investors.

Immutability

Immutability requires a bit of explanation.

Bitcoin and Ethereum have three key stakeholders:

Users (investors)

Developers (software engineers)

Miners/validators (people who own the equipment to verify transactions in the network)

Out of all cryptocurrencies, Bitcoin is the only protocol with track record of being truly immutable.

Immutability means that all these three stakeholders are in a beautiful equilibrium. Meaning, none of these groups alone can change the protocol, e.g. increase the supply of Bitcoin. Miners cannot do it. Users cannot do it. And even the core developers cannot do it. It will forever stay at 21 million.

If core developers of Bitcoin want to change something, they need approval from over 50% of all the Bitcoin miners who verify transactions of the Bitcoin network. Besides incremental upgrades and small fixes, the miners have no incentive to do any large changes to any direction, because that would just risk the safety of the protocol and their Bitcoin wealth. The Bitcoin community is fairly stagnated when it comes to innovation. Bitcoin updates fairly rarely, compared to other crypto projects. However, this is exactly how the majority of all Bitcoin stakeholders want it to be. They simply want Bitcoin to be the safest Store of Value — no gimmicks.

Bitcoin was founded by the pseudonym Satoshi Nakamoto in 2009. Satoshi sent his last message in 2011, where he made it clear that he has “moved on to other projects”. The first known Bitcoin developer after Satoshi was software engineer Hal Finney. Hal Finney passed away in 2014. None of these original core people has been around for seven years. The founders don’t influence the protocol because they are not around anymore.

To summarize, immutability means stakeholder equilibrium (users, miners, developers) and the absence of founders.

If you think about immutability on all other crypto projects, things look very different, including Ethereum.

Nearly all other crypto projects have been started by people who are publicly known. Usually, the team has significant expertise, so these founders are strongly promoted to create credibility. The founding team usually holds anything between 5-20% of the initial supply of the crypto coins. Their expertise, and the fact that they own significant voting power in the protocol, make it possible for them to direct the protocol in the direction they want. Usually, they have good long-term intentions for the entire community, of course. However, in theory, they can make malicious decisions.

Regarding Ethereum, when it comes to immutability, we must talk about the infamous DAO hack — short for Decentralized Autonomous Organization. The DAO was created by a German start-up called Slock in June 2016, and within a month of launching over 150 million dollars’ worth of ETH had been deposited into the DAO smart contract. On June 17th 2016, an anonymous hacker stole 50 million dollars’ worth of ETH from the DAO smart contract, equal to about 5% of all the ETH in circulation at the time. Ethereum camp at that time was divided into two groups. The smaller minority was touting the ‘code is law’ principle, willing to stick to the immutability. The other group thought that not reversing the stolen funds would be riskier to the entire Ethereum project as a whole. After disagreements, Ethereum eventually hard-forked on the 20th July 2016, creating two separate blockchains: Ethereum (ETH) and Ethereum Classic (ETC). This meant that in Ethereum chain the DAO hack never happened, and in Ethereum Classic chain the ETH remains stolen for better or for worse.

To sum up the story, the hard-fork was probably the right thing to do at the time, but at the same time demonstrated that the protocol was far from being immutable.

Stability of codebase

Bitcoin’s codebase is much more stable than Ethereum’s codebase. There is about one-third of activity in Bitcoin’s codebase compared to Ethereum’s codebase.

The culture of these communities is really different. Bitcoin values stability, immutability, and only small necessary upgrades. Bitcoin is more in the ‘maintenance’ phase, while Ethereum is under heavy development, going through massive upgrades. Some people are referring to Ethereum as a flying plane, that’s being fixed and upgraded while it is in the air.

PS. measuring the codebase activity is actually not a straightforward task. For e.g. Github commits give misleading picture (E.g. Cryptomiso is misleading). One needs to look at this more holistically, such as Santiment is doing. Valentin Mihov has explored this topic in his blog post.

Protocol simplicity

Bitcoin’s aim is simple: to create consensus on its distributed ledger. You can store and send value. That’s it.

Ethereum as a protocol is much more complicated. Its ambition is also very different. Ethereum aims to be the world’s blockchain computer. Not only can you store value in Ethereum, but you can store any programs there. Indeed, Ethereum is a Turing-complete computer. This makes Ethereum many magnitudes more complicated protocol compared to Bitcoin.

Not only is the codebase of Ethereum much larger than the codebase of Bitcoin, but the amount of data stored in Ethereum is also significantly larger. Full Ethereum blockchain as of today is about 783 gigabytes. Full Bitcoin blockchain is about 345 gigabytes. When comparing these numbers, you also need to take into account that the Bitcoin blockchain has been active for 6 years longer than the Ethereum blockchain.

The larger the blockchain gets over time, the more difficult it will get for an ordinary man to mine the network. Normal computer and typical hard drive won’t be enough. Mining will get increasingly centralized to large data centers and huge mining pools.

Speed of innovation

I’ve just covered Stability of Codebase and Protocol Simplicity. Bitcoin naturally wins this battle from the Store of Value point of view.

However, we need to look at the flip side of the coin: Speed of Innovation. Ethereum is just light years ahead of Bitcoin in innovation and new development.

I think co-founder of Ethereum Vitalik Buterin summarized the difference between Bitcoin and Ethereum very well on Bankless podcast:

“Legitimacy is always different in different communities. There definitely is a cultural difference in Ethereum and Bitcoin communities. Ethereum people are more accustomed valuing Ethereum based on its future, where as Bitcoin people are much more accustomed to valuing Bitcoin based on its presence. Bitcoin people think Bitcoin is 80% complete. Ethereum people think Ethereum is 40% complete. And both sides are comfortable with that, and think the other side is crazy for taking the opposite choice.”

It’s easy to agree with this analysis. Bitcoin wants to be a simple protocol and its community is comfortable only with small incremental upgrades. While as Ethereum is complex platform and its community wants to develop it much further, with many opportunities ahead.

The speed of innovation is definitely Ethereum’s strong point, and can be witnessed with its native support for smart contract and NFTs. These two traits are explored in the following two paragraphs.

NATIVE Support for Smart contracts

Bitcoin doesn’t support smart contracts. While Bitcoin is programmable, you can develop only limited-functionality apps on it.

Ethereum is fully programmable and smart contracts are its main feature.

There are pros and cons to this.

Having no smart contracts keeps the protocol itself simple, which is good for safety and good for a Store of Value. Points for Bitcoin.

However, smart contracts enable an enormous amount of digital apps developed on top of the blockchain. The entire financial sector is being replicated to the blockchain through numerous projects — a movement known as Decentralized Finance (or DeFi). Most of these applications are developed on top of the Ethereum blockchain. These products will lock an enormous amount of value to the Ethereum blockchain (79 billion USD as of today). That’s good for network effect and ultimately store of value.

Explore the total value locked in Decentralized Finance projects on https://defipulse.com/

PS. Regarding Bitcoin blockchain, there are some layer 2 solutions, which do enable smart contracts and NFTs. For example, with Stacks you can run smart contracts that will be periodically settled on the native Bitcoin blockchain. Sovryn has built decentralized exchange in Bitcoin sidechain, with the aim of smart contract support in the future. Quite a stretch, indeed. Let’s see how these plays out.

Native support for NFTs

The other massive change is NFTs, or non-fungible tokens, which enable ownership coordination using blockchain. For example, pieces of digital art can be easily purchased and sold online, and the ownership transfer can be verified using blockchain technology.

NFT space is growing massively. More than USD 2 billion was spent on NFTs during the first quarter of 2021 — representing an increase of about 2,100% from Q4 2020 — according to a new report NonFungible.com.

A few decades from now, NFTs could represent ownership of most asset classes, such as real estate and cars. Imagine the future where your Tesla car ownership is recorded in NFT. When you want to sell your Tesla, you just auction the digital NFT ownership token online, and Tesla will self-drive to the new owner. Easy, huh? The potential of NFTs is massive. There are already hundreds of millions of real world assets such as real estate and bonds being tokenized. You find a good summary in this article.

Bitcoin blockchain doesn’t natively support NFTs. Keeping the protocol simple is a good trait for a Store of Value asset. That said, Bitcoin might be missing out on the enormous growth of NFTs, even though some layer 2 solutions like Stacks have been built.

Ethereum supports NFTs natively. Most NFTs are minted in the Ethereum blockchain. Ethereum has enormous potential locking most of the future NFT value.

Beeple’s NFT art work, Everydays: The First 5000 Days, sold at Christie’s for $69 million dollars, the sale positioning him as “among the top three most valuable living artists”

Native support for staking (yield)

In the opening of the blog post, I mentioned that Ethereum has traditionally been categorized as “Digital oil” but it’s now being transformed as “Digital bond”. What does this comparison mean?

To understand this, we need to understand what ‘staking’ means. Traditional finance does not understand ‘staking’. Staking is a feature of Proof of Stake blockchains. The upcoming Ethereum 2.0 upgrade is a Proof of Stake blockchain.

(To clarify — At the time of writing this blog post in May 2021, the current version of Ethereum still uses Proof of Work consensus mechanism, and does not have staking functionality.)

To simplify, staking means locking your ETH for a certain period. These locked ETHs are used to validate transactions and secure the network. As a reward for locking your ETH, you are rewarded with new coins from the network.

ETH ‘staking’ is like a bond offering for a new type of digital nation. Traditionally, we think an economy is connected to a nation state. For example, we speak about “US economy” and “China economy”. Ethereum can be thought of as a global digital economy without physical borders.

Reserve asset of the traditional fiat economy is US dollar. Reserve asset of the Ethereum economy is ETH, and that is also used as the main collateral in its digital app economy.

Traditional economies have their government-issued bonds with yield. Ethereum economy has staking yield.

Unlike a traditional bond, staked ETH has no counter-party risk – there is only protocol risk. Staked ETH gives you yield at the protocol level and not via a counter-party. Staked ETH is therefore an intrinsic yield instrument.

You might think is just semantics. One might also argue that you can earn yield with Bitcoin. Yes, you can earn yield with Bitcoin, but there is always counter-party risk, and you need to store it to one of the Decentralized Finance protocols. Yield in Ethereum is intrinsic to the protocol itself.

Minimal attack surfaces

The Bitcoin blockchain is genuinely decentralized. It has over ten thousand full nodes in over 100 countries mining and securing the network. It’s extremely difficult to shut down the network by anybody or any powerful organization, such as the government. If you shut down the entire Internet in one country or even one continent, it doesn’t have a fundamental threat to the Bitcoin network itself.

Ethereum, on the other hand, has many potential surfaces for external attack. While it’s an oversimplification, one can argue that the Ethereum network could be significantly tampered with two phone calls by the government (asking Amazon to shut down AWS hosting for Ethereum dapps and asking Infura company to stop its services).

While the Ethereum community intends to increase decentralization and safety, the reality of today is quite different.

You can explore this topic more in this CoinDesk article.

Geographical decentralization of mining pools

Mining pools are groups of cooperating miners who agree to share block rewards in proportion to their contributed mining hash power. While mining pools are desirable to the average miner as they smooth out rewards and make them more predictable, they unfortunately concentrate power to the mining pool’s owner.

Mining centralization in China is one of Bitcoin’s largest issues at the moment.

There are about 20 major mining pools, and about 65% of Bitcoin blockchain’s hash power is controlled by mining pools located in China. This has happened simply because Chinese government subsidizes electricity production, and electricity is really cheap compared to almost anywhere else on the planet.

Due to the pressure from the Chinese government, this number is gradually decreasing, though. China-based mining pools are increasingly locating abroad, which is good for the security of the Bitcoin blockchain.

Chart from https://www.buybitcoinworldwide.com/mining/china/

Mining pools heavily compete with each other, and they have full incentives to play by the rules. Moreover, miners can choose to redirect their hashing power to a different mining pool at any time.

However, what would happen in the unlikely event of malicious attacks to the mining pool companies, e.g. through government pressure?

If the hostile action were significant enough, it would be first of all noticed very quickly due to the transparent nature of the blockchain ledger. Secondly, if the attack would truly question the legitimacy of Bitcoin, the social layer (people) would step in to have their say. (Vitalik Buterin has a great blog post about the scarce resource of legitimacy in the blockchain world.) In this this case, Bitcoin would most likely be hard forked to a new blockchain with malicious transaction reversed. Something similar to what happened between Bitcoin and Bitcoin Cash. That said, a large successful attack against Bitcoin would nevertheless leave deep scars.

With Ethereum 2.0 there is no risk of geographical centralization of validators. This is because validating Ethereum 2.0 Proof-of-Stake blockchain is not dependent on cheap electricity. This means that validator nodes can be run anywhere on the planet with the same incentives.

Full replication of database

One fundamental security design of Proof of Work blockchain is the full replication of database. The full ledger is copied to as many nodes globally.

In Ethereum 2.0, the database is fragmented with a technology called ‘sharding’. Sharding increases performance but further reduces security and increases the number of attack surfaces.

Backed by LAWS OF PHYSICS

This might be the most important features of Proof of Work-based consensus mechanism. Bear with me, we will dive into high-school physics.

The second law of thermodynamics states that entropy (“randomness”) of the total system always tends to increase. One can create low entropy of a sub-system by dumping extra entropy elsewhere. With Bitcoin and Proof of Work (PoW) consensus mechanism, the extra entropy being dumped is heat from the mining rigs. This creates the reduced entropy locally, which are the numbers in the ledger.

As Michael Saylor says, once you understand money is monetary energy and you understand Bitcoin is a monetary energy network, then you start to appreciate the fact that it either does or does not respect the laws of thermodynamics. If it doesn’t, it means it has a leak.

Considering the fundamentals of physics and thermodynamics, Proof of Work seem to be the ultimate consensus mechanism.

Now, although I’ve been researching this topic quite a bit, I do not have a Ph.D. in physics. That’s why, besides the first principle analysis of my own, I need to trust some of the leading physicists in the field, such as Stanford professor Shoucheng Zhang. If you fire up the Wikipedia page of Mr. Zhang, you can see that he probably knows what he is talking about.

For those interested in deep diving into physics, I found his 1-hour lecture at Google Talk fascinating. If you insist on fast-forwarding to the beef, you can start the video at the timestamp 43:40. He addresses the Proof of Work versus Proof of Stake question. He believes that, at the fundamental layer, Proof of Work is a more secure mechanism than Proof of Stake. At the same time, he believes that there is room for Proof of Stake in many business applications. The ultimate settlement layer would still need to happen in the most secure chain, which is the Proof of Work chain.

Ethereum is currently using Proof of Work but will shift to Proof of Stake with Ethereum 2.0 upgrade. This will reduce the energy consumption of the Ethereum blockchain by 99%, but potentially decreases the security of the network.

Ultimately, it’s a good trait for the Store of Value protocol to be dependent on laws of physics (Proof of Work). In Proof of Work you have sunk computational and electricity cost to secure the network (mining). That’s why Bitcoin is often referred to be thermodynamically the hardest asset on the planet.

Proof of Stake, on the other hand, is based on game theory. There are no sunk cost. Validator nodes use same amount of electricity as a normal computer. The security of the Proof of Stake network is based on rules and regulations between the the different type of validator nodes.

That said, Ethereum’s main goal is to be a platform for business applications. The level of security Ethereum provides is enough for most of them. Scalability is understandably more important to Ethereum 2.0 than safety.

PS. One interesting new consensus mechanism currently developed is Proof of Space-Time (PoST), introduced by the Chia network. Instead of CPU/ASIC power, it will use hard drive storage space for mining. It will consume significantly less energy than the Proof of Work Bitcoin network. I believe this can be much secure than Proof of Stake, and close to the security of Proof of Work. Chia’s founder Bran Cohen brings lot of credibility behind this protocol. He is the inventor of BitTorrent, and one of the most experienced developer of decentralized protocols in the world. The project has just recently launched its main net, so let’s see how this plays out over the years.

DIVISION OF POWER

In Bitcoin and Proof of Work systems, full node operators who maintain the ledger, can delink from block creators if they become corrupt of dysfunctional to the network.

In Ethereum 2.0 this is impossible, as they are stuck with the validators who stake the required amount of ETH. This decreases the censorship resistance.

My summary

First of all, I think no one can see further than five years ahead in crypto development with any meaningful level of confidence. Five years ago was 2016. Ever since, we’ve experienced ICO boom, DeFi summer, and the NFTs to take off. Who could have predicted all this in 2016? And for the next five years, the pace of innovation is just increasing.

Bitcoin will remain as the best Store of Value asset for the next few years. Bitcoin is a simple Store of Value protocol and uses a consensus mechanism that has endured the test of time for over 11 years. Laws of physics back it. It has predictable supply development and minimal attack surfaces. The protocol is already in ‘maintenance mode’ and has never been hacked. All these are good traits for a Store of Value asset. One theoretical threat is mining pool centralization in China, but this has gradually decreased over recent years.

However, Bitcoin is missing out from the enormous influx of capital invested in Decentralized Finance platforms and NFTs, because Bitcoin doesn’t have native support for smart contracts or NFTs. That said, currently, Bitcoin does its job as a Store of Value more safely than anything else.

Ethereum’s role as a platform and “world’s blockchain computer” will increase rapidly year over year. Decentralized Finance protocols and NFTs are predominately being built on top of Ethereum. An increasing amount of wealth is being locked in digital apps on the Ethereum blockchain. Due to the massive increase in activity in different decentralized apps, Ethereum has already exceeded Bitcoin in transaction volume.

Ethereum is about to implement the EIP-1559 transaction pricing mechanism in July 2021. This will significantly change the token economics of the protocol, and if everything goes as predicted, it makes Ethereum an increasingly scarce asset with a higher price. Besides this, Ethereum is transforming from a Proof of Work to a Proof of Stake consensus mechanism in the end of 2021. This enables intrinsic yield accumulation for ETH without counter-party risk, something that is not possible with Bitcoin.

Ethereum is great for many business applications, but as an ultimate Store of Value, Ethereum 2.0 and the Proof of Stake consensus mechanism are not time-tested. Instead of fundamental physics, Proof of Stake is based on game theory. Moreover, Ethereum has some centralized elements and surfaces for external attack.

Both Proof of Stake and EIP-1559 upgrades are massive, and there’s a lot of positive change and innovation ahead. That said, Ethereum is still a protocol in a relatively early stage of development. Vitalik Buterin himself has said that Ethereum people consider Ethereum about 40% complete. There are a lot of opportunities ahead and the same amount of risks. Risks are not good traits for Store of Value asset.

Only time will tell if Ethereum can deliver all the promises. If Proof of Stake turns out to work well. If EIP-1559 brings the highly anticipated token economic changes. If sharding is successfully implemented and transaction fees stay at reasonable levels. And if all these features are delivered timely — before other smart contract blockchains ride ahead. Yes, in this case, transaction volume on Ethereum will likely be multifold compared to Bitcoin in the next bull cycle. In this case, there is a high likelihood for Ethereum ‘flippening’ Bitcoin market cap. There’s just lot of ifs.

I’m invested both in Bitcoin and Ethereum, with about equal allocation. Both have their place and purpose. Bitcoin as the safest Store of Value, and Ethereum as the new digital economy and world’s blockchain computing platform. I believe both have a great future.

In this bull cycle in 2021, while Ethereum has a chance to reach a higher market cap than Bitcoin temporarily, I don’t believe Ethereum permanently flippening Bitcoin’s market cap. The security fundamentals are still on Bitcoin’s side. Ethereum needs to go through its updates successfully and mature into ‘maintenance mode’ over the following years to prove its trustworthiness as a Store of Value.

For retail investors, all this meticulous analysis might not be that important. However, large institutional investors care about the fundamentals, and I see their money flowing predominantly to Bitcoin in the next few years. Ethereum will be the next one on their radar.

In the big picture, decentralized consensus technologies are still being heavily developed. Bitcoin (and Proof of Work) was the first one to solve consensus of decentralized ledger successfully. Bitcoin will hold the status of safest Store of Value for the next few years at minimum, thanks to its brand, largest user base and time-tested consensus mechanism. That said, it is not set in stone it will be the safest consensus method forever. New blockchain projects will likely try everything imaginable (e.g. PoW and PoST) to secure the consensus. Over a long period, considering numerous factors (e.g. decentralization, safety, scalability and environmental sustainability), we can see what are the most suitable ones to remain.

Above all technical discussion, there is one certainty.

Human psychology is wired the same way today as in the 16th century when Hernán Cortés invaded Aztec. We all look for safety and reliability when storing value we have accumulated with hard work.

About the author

Mikko Ikola is passionate about blockchain and disruptive protocols in the decentralized world. You can follow @MikkoIkola on Twitter and contact Mikko via email at last-name@iki.fi.

Thanks

Thank you Mikko Alasaarela, Voitto Kangas, Teemu Laurikainen, Marcus Ohlsson, Juuso Takalainen (in alphabetical order), for invaluable feedback pre-reading this article. I would not have been able to make as comprehensive and as balanced analysis without you.

Email newsletter

If you’d like to stay updated on my future crypto articles, you can subscribe to my newsletter at the bottom of this page.

MAIN RESOURCES:

Bitcoin Standard (Ammous Saifadean, Apr 24, 2018) — Read my review!

Infinite Machine (Camila Russo, Jul 14, 2020) — Read my review!

An Economic Analysis of Ethereum (Lyn Alden, Jan 25, 2021)

Open Reply to Lyn Alden & Ethereum Skeptics (David Hoffman and Lucas Campbell. Jan 22, 2021)

Why Proof of Stake Is Less Secure Than Proof of Work (Donald McIntyre. Oct 7, 2019)

EIP-1559 transaction pricing mechanism improvement proposal (Github)

Special remarks:

Bankless podcast in general — thanks for amazing interviews

Coin Bureau YouTube channel — unbeatable analysis of all major crypto protocols

Coinmarketcap and Coingecko for day-to-day overview on markets

Collection of all links mentioned in this article:

Coin360 visualization tool [Coin360.com]

GDP by countries [Wikipedia.com]

Bitcoin Treasuries [Bitcointreasuryreserve.com]

‘Ultrasound money’ meme graph [Twitter.com]

Collapse of Bretton-Woods system [IMF.com]

Debasement and the decline of Rome (Kevin Butcher. 16 Nov 2015) [Warwick.ac.uk]

RAI stones in Yap island [Smithsonianmag.com]

Examples of hyperinflation [Wikipedia.com]

WTF happened in 1971 [Wtfhappenedin1971.com]

List of public companies holding bitcoin [Coingecko.com]

Governments are looking to buy Bitcoin, NYDIG CEO confirms [Cointelegraph.com]

The Flippening (Ethereum vs. Bitcoin) [Blockchaincenter.com]

Bankless podcast #44: Modeling Ultra Sound Money | Justin Drake (Apr 28, 2021)

Santiment codebase analysis [Santiment.net]

Tracking GitHub activity of crypto projects — introducing a better approach (Valentin Mihov. Apr 18, 2018) [Medium.com]

Ethereum Chain Full Sync Data Size [Ycharts.com]

Bitcoin Blockchain Size [Ycharts.com]

Bankless podcast #64— Vitalk Buterin (May 10, 2021) [Youtube.com]

DeFi Pulse — Total Value Locked in Decentralized Finance [Defipulse.com]

Stacks — Smart contracts and NFTs on Bitcoin blockchain [Stacks.co]

NonFungible NFT market tracker [Nonfungible.com]

The Race Is On to Replace Ethereum’s Most Centralized Layer [Coindesk. Dec 5, 2018]

Bitcoin Mining in China (May 12, 2021) — [Buybitcoinworldwide.com]

Michael Saylor — Bitcoin: Creation Of Immortal Power [Youtube.com]

Shoucheng Zhang [Wikipedia.com]

Talks at Google: Quantum Computing, AI and Blockchain (Shoucheng Zhang. Jun 7, 2018) [Youtube.com]

Proof of Space-time [Wikipedia.com]

Chia network [Chia.net]

Disclaimer: No financial advice – The Information on this blog post and on the entire website in mikkoikola.com, is provided for educational, informational, and entertainment purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented on this website without undertaking independent due diligence and consultation with a professional broker or financial advisory. You understand that you are using any and all information available on or through this website at your own risk.